1. LIC INSURANCE POLICIES:

The Trust has taken following 02 policies for the employees as under:

• Policy No. 342584: This is applicable only for the employees who joined the Society (KRIBHCO) till 30.09.2013.

• Policy No. 103009890: This is applicable only for the employees who joined the Society (KRIBHCO) on and after 01.10.2013.

The contribution is made by the Society out of the incentive/pension fund payable to the employees as per the Productivity Incentive Scheme out of its profit. The contribution is made in the month of September / October every year. Further, option is also available to the employee to contribute optional/voluntary subscription every month out of their salaries. Interested employees may submit their option by logging into their KRIBHCO's ESS portal under Employee Self Service/Benefits and Payments/Reimbursement Module ‐ Claims /Advances and select appropriate option. On receipt of contribution from the Society, the same is being remitted to LIC every month.

Further, members can view their Fund Value towards LIC Pension online through LIC Portal on the following links:

If already registered with LIC

Go to https:www.licindia.in > Go to Login scroll & click>Group customer/Annuitant > CLICK HERE for Group Customer/Annuitant Login > Go to Pension and Group User> CLICK HERE to Login > User Name > Password

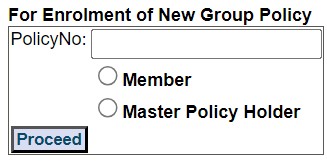

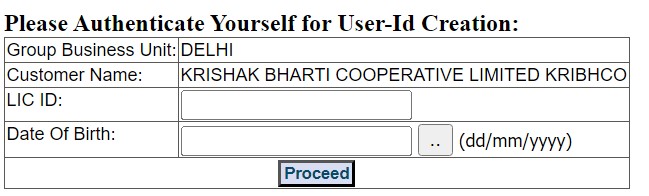

Click here for new Enrolment

>NEW REGSTRATION

Enter policy no 342584 OR 103009890 and Click on Member

(Note: Personal no is LIC ID for Policy no 342584 and for policy no 103009890 different LIC ID which can be seen on Salary slip)

Now create Login id and password to view their Pension Fund Balances.

2. TERM INSURANCE:

The Trust has taken term insurance policy from Life Insurance Corporation of India (LIC) for each member for a sum of Rs. 10.00 Lakh who are members of the above 02 policies. The insurance premium of the policy is being deducted out of contribution to the fund paid by the Society from incentive amount. In case of mis-happening, the claim is to be submitted by the registered nominee to the Trust through respective HR Department along with required documents. List of required documents are given in the Option Forms Applicable

. It is clarified that term insurance is applicable from the date of 1st contribution along with term insurance premium is paid to the LIC. For example, employees who joined the services of Society during 2021-22 (01.04.21 to 31.03.22), their pension amount will be paid in the month of October 2023 along with term insurance premium and their policy will start from October 2023 only.

3. FORMS TO BE SUBMITTED AT THE TIME OF SUPERANNUATION:

The policy is valid up to the age of 65 years, if members wish to continue and pay the premium from own account after superannuation. Any member interested to take pension can exit the policy after last contribution of premium is made to LIC by the Society. The pension is to be fixed after non eligibility of incentive to the employees. For example, an employee superannuating during 2021-22, the incentive is payable for the year 2021-22 on 30.09.2022. The term insurance policy will be renewed on 01.10.2022 and will be valid up to 30.09.2023. The pension will be fixed after 30.09.2023. The form submitted by the employee at the time of superannuation during 2021-22 (date of superannuation) will be sent to LIC during the first week of November 2023.

4. FORMS TO BE SUBMITTED FOR RETURN OF CAPITAL (ROC) on Death of a Pensioner/Annuitant

In case pensioner expires, nominee(s) have to fill claim form for Return of Capital.

5. FORMS APPLICABLE (For forms, please click desired option):

(a) Application for pension on retirement of leaving the Services of Employer

(a) Guidelines for Superannuating Policy

(d) Nominees Pension Form on Death of working employees

(e) Life Existence Form is to be filled after 5 years from start of pension and thereafter every 5 years.

(f) Return of Capital (ROC) Claim form in case of death of Pensioner/Annuitant

Documents to be submitted with Forms has already been mentioned in the respective forms